Worth Up To PKR 75 Billion, This is the Largest Long-Term Private-Sector Syndicated Credit Facility.

KARACHI – July 19, 2024: Jazz, Pakistan’s leading digital operator, has successfully secured the largest private sector syndicated credit facility, totaling up to PKR 75 billion. The banking consortium was led by The Bank of Punjab (BoP), and this 10-year financing arrangement will significantly support Jazz’s ongoing 4G network expansion and technological upgrades while supporting its new ServiceCo model.

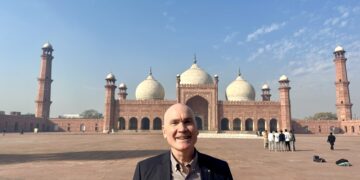

The signing ceremony, held at a local hotel in Karachi, was graced by Mr. Kaan Terzio?lu, VEON Group CEO, Mr. Aamir Ibrahim, CEO of Jazz, and the Presidents of participating banks along with their representatives. The consortium includes prominent financial institutions acting as mandated lead advisors and arrangers, namely Habib Bank Limited, Bank Alfalah Limited, Meezan Bank Limited, MCB Bank Limited, Allied Bank Limited, The Bank of Punjab, Askari Bank Limited, Habib Metropolitan Bank, Soneri Bank Limited, Bank Islami Pakistan Limited and MCB Islamic Bank Limited.

Jazz, a major investor in Pakistan with over 30 years of history and investments exceeding USD 10.6 billion, leads the industry with a 45% revenue market share and serves over 71.4 million subscribers, including 49 million 4G users. The company recently announced a major shift from a traditional mobile operator to a ServiceCo structure, creating Strategic Business Units (SBUs) focused on digital financial services, software & analytics, data centers & cloud, and entertainment & digital platforms.

Mr. Aamir Ibrahim, CEO of Jazz, remarked, “By investing in cutting-edge digital infrastructure, we are committed to bridging the digital divide and promoting financial inclusion across the nation. This transaction reflects the financial community’s trust in Jazz’s solid market reputation and our leadership on the digital front. It is a crucial step toward ensuring that all Pakistanis, regardless of location, gender, or socioeconomic status, can harness the transformative power of the internet and digital services.”

Mr. Zafar Masud, President & CEO of The Bank of Punjab, stated, “Leading this landmark transaction in the telecom sector exemplifies our strategic focus on digital transformation in Pakistan. Our partnership with Jazz underscores BoP’s dedication to advancing technological progress and supporting the growth of the telecom industry. This deal is a testament to our commitment to driving innovation and fostering economic development in the country.”

In June 2021, Jazz secured a PKR 50 billion 10-year syndicated credit facility from a banking consortium led by HBL. Earlier on, Jazz announced the successful closure of its Rs. 15 billion Sukuk, marking a milestone as the first-ever and largest short-term unsecured Sukuk by a telecom operator in Pakistan, which is expected to boost the use of Shariah-compliant financial instruments within Pakistan’s capital markets.