NdcTech, a premium technology services firm transforming banks and financial institutions globally has successfully modernized the core banking system of Samba Bank onto the latest release of Temenos Transact.

Samba Bank Limited is a subsidiary of Saudi National Bank (SNB) KSA in Pakistan, offering personal and corporate banking services, including current and savings accounts, loans investments and a host of digital services. The bank serves a sizable customer base and has a branch network across 14 major cities in Pakistan.

Over the years, Samba Bank has fostered a long-term partnership with NdcTech and Temenos to fulfill their vision of hyper-scaling the bank’s presence through digitization rather than traditional channels. The bank needed to upgrade to a modern, flexible, and scalable core banking system that could support its business growth objectives.

Moving onto the latest release of Temenos Transact is a steppingstone for the bank to harmonize its IT infrastructure and speed up digitization. The flexible, modular, and scalable platform by Temenos is API driven making it capable to fulfil the complex needs of banks and financial institutions.

NdcTech’ unique implementation methodology incorporating innovative tools and techniques accelerated this transformation for the bank. The team successfully upgraded all modules for Samba bank including Core, Retail, Lending, Deposits, FCM, and Trade finance to the latest release of Temenos Transact. NdcTech combined the use of the latest version of Pakistan Model Bank to meet the local regulatory requirements, update tax changes, and modernize trade processes for the bank. NdcTech also incorporated Image-Based Cheque clearing system and low balance alert system for the bank to reap benefits of the modern functionalities for seamless banking operations.

Samba Bank is now on the path to realize the benefits of the dynamic and efficient platform to achieve long term growth. The bank has gained greater product agility, improved time-to-value and accelerated speed of innovation to make business decisions rapidly. The new system enables faster transaction processing times, automates several manual processes and reduces operational costs, resulting in improved efficiency and productivity. It also allows the bank to develop and market new products easily and rapidly. This flexibility enables the bank to respond quickly to the changing market dynamics and enhance competitiveness in the banking industry.

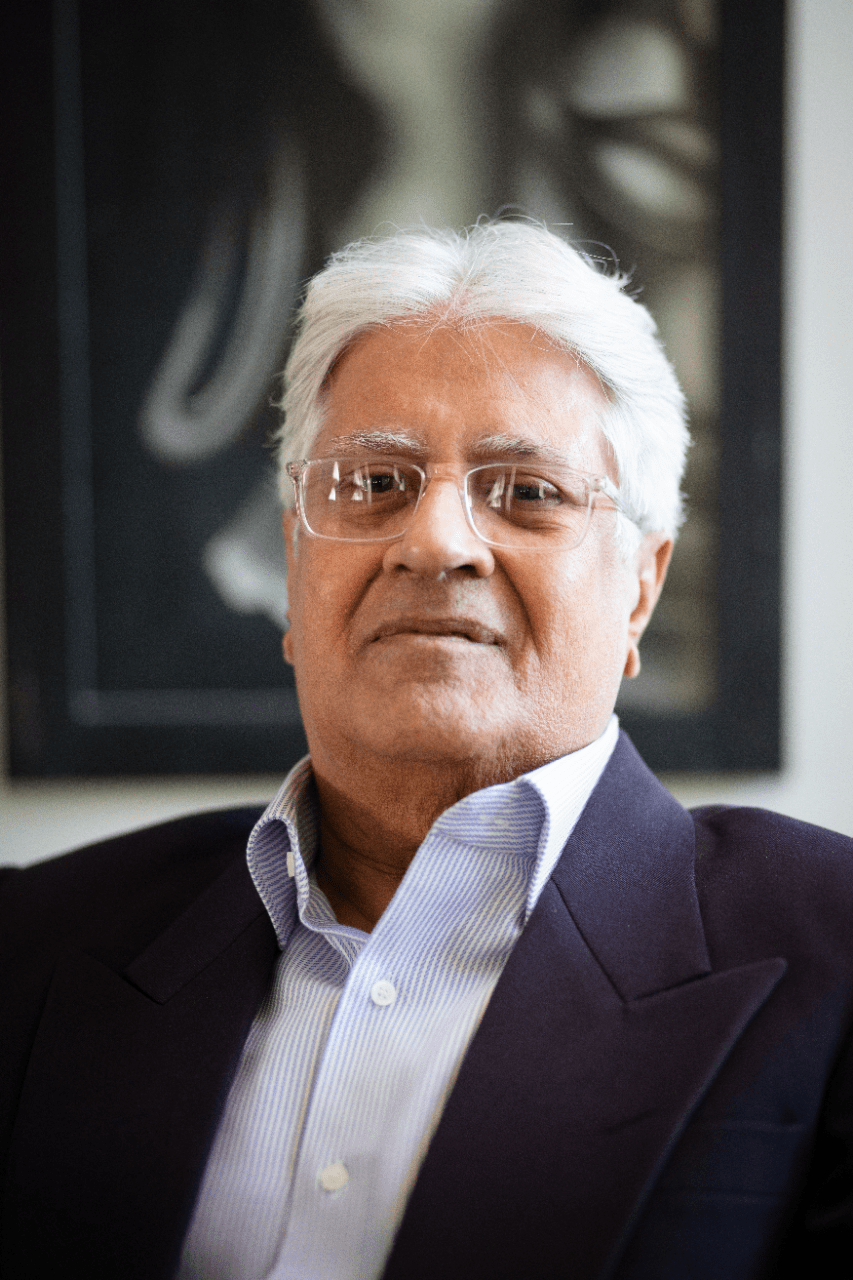

On this occasion, Ahmad Tariq Azam, President & CEO (Acting), Samba Bank Limited said:

“We are pleased to announce that Samba Bank has successfully modernized its Core Banking Platform onto the latest release of Temenos Transact with NdcTech as the strategic partner. Working closely with NdcTech and Temenos over the years has enabled us to drive digital change and future proof the ongoing growth of Samba Bank. Samba Bank is now at the forefront of capability to deliver innovative and state of the art financial services to its customers and envisions to constantly innovate its processes and offerings to keep pace with the evolving digitization of banking industry.”

Ammara Masood, CEO, NdcTech said:

“I would like to congratulate the Samba management and teams for their collaboration with us to modernize Core Banking and Financial Crime platform. NdcTech has been a trusted partner of Samba for almost a decade, and we take pride in consistently delivering value that has helped the bank achieve its digital vision and drive business growth. NdcTech has an established track record of successful upgrades delivered using our methodology, automated tools, and accelerators like Country Model Bank. We use implementation capabilities for building a future-ready bank, making us the ideal partner for banks and FIs like Samba Financial.