Dubai: 1st February 2024: Mashreq, a leading UAE bank, has announced its financial results for the fiscal year 2023, demonstrating a strong commitment to client-centricity and operational excellence. The bank’s net profit has surged by 130% to reach an unprecedented AED 8.6 billion, driven by a 69% increase in net interest income. This growth is primarily due to business growth, robust client margins, and positive one-offs related to loan loss provisioning. Non-interest income reached AED 3.1 billion, marking a 13% year-on-year growth.

The bank’s cost-to-income ratio improved by over 8% year-on-year, indicating strong business performance with effective control over operating costs while enabling continued investments in enhancing client experience, risk management, and supporting business growth. Operating profit increased from AED 4.4 billion to AED 7.5 billion in FY 2023, representing a 70% increase compared to the same period in 2022. The allowance for impairments experienced a net release of AED 1.4 billion, driven by prudent risk management, high recoveries from Non-Performing Loans (NPLs), and a one-off release of the General Provision.

Mashreq’s return on equity (ROE) reached a record-high of 34.3% in FY 2023, doubling compared to FY 2022, while the cost-to-income ratio decreased to 30.9%. The bank’s capitalization level remains robust, with a Liquid Assets ratio of 33.6% and an efficient Liquidity Coverage Ratio of 134% as of December 2023.

The bank’s financial strength and efficiency are evident in its Capital Adequacy Ratio standing at 16.5%, a stellar Return on Equity (ROE) of 34.3%, and an efficient Cost-To-Income Ratio of 30.9%.

Mashreq, a leading UAE bank, has been focusing on enhancing operational efficiency and strengthening risk controls to maintain its strong business model. The UAE banking sector reached a historic high in 2023, with total assets crossing the AED 4 trillion mark. The bank’s commitment to sustainable finance is reflected in its “Rise Every Day” mantra, which serves as a guiding beacon in every aspect of its operations.

The bank’s performance this year has been exceptional, reflecting its strategic direction within the global economic and political landscape. The bank’s strategy and robust operational execution have been pivotal in achieving growth across all businesses and geographies. Consistent recognition by prestigious institutions like Euromoney Market Leaders and client votes reaffirms its commitment to delivering superior customer experiences and pioneering innovative technology.

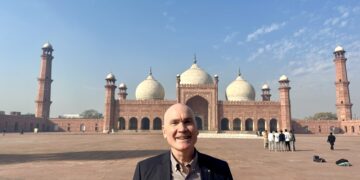

Mashreq’s AED 110 billion commitment to sustainable finance announced during COP28 is part of its “Climb2Change” global initiative, which integrates the bank’s ESG milestones and its impactful contributions to combat climate change and a net zero inclusive future. Internationally, the bank has achieved robust growth in its international operations, expanding into new markets such as Pakistan and Oman. In addition, intensified efforts in well-established markets like the UK, Hong Kong, and the US are primed for future growth.

Despite ongoing uncertainty, Mashreq’s course and position remain resolute, with a stable, robust, and resilient business model. However, adjustments in operational strategies will be necessary due to the normalization of interest rates. Despite this, Mashreq’s formidable presence within the banking sector, underpinned by intellectual capital, a commitment to leveraging technology to enhance clients’ experience, and a prudent approach to risk management, will empower it to maintain its prominent market position.

The financial performance of Mashreq Capital, a leading Islamic retail bank in the UAE, has been recognized by various awards and recognitions. The company has been recognized for its innovative use of AI and analytics in customer analytics, as well as its outstanding digital transformation in the UAE. The bank has also been recognized for its exceptional service in various industry sectors in the Middle East and Africa.

In the financial year 2023, Mashreq Capital received several awards, including the 10th annual WealthBriefing MENA Awards for Excellence, the Asian Banker (TAB) Global Middle East and Africa Awards, Global Finance’s 3rd annual SME Bank Awards for 2024, the Middle East & Africa (MEA) Finance Industry Awards 2023, the GIFA Excellence Award for Islamic Banking, and the ‘Most Innovative Companies Middle East Award’ by Fast Company Middle East.

The bank has also been recognized for its mobile remittance app, which won the ‘Best Mobile Remittance App Award’ at the FXB payment summit 2023. Additionally, it has been recognized for its commitment to sustainability and innovation in the banking sector.

The bank has also been recognized for its outstanding service in various industry sectors and service groups in the Middle East, Qatar, Bahrain, and Egypt. The bank has also been recognized for its excellence in NEO Banking and has been recognized for its innovative use of AI and advanced analytics in customer analytics.

Overall, Mashreq Capital has been recognized for its exceptional financial performance and commitment to innovation in the banking sector.