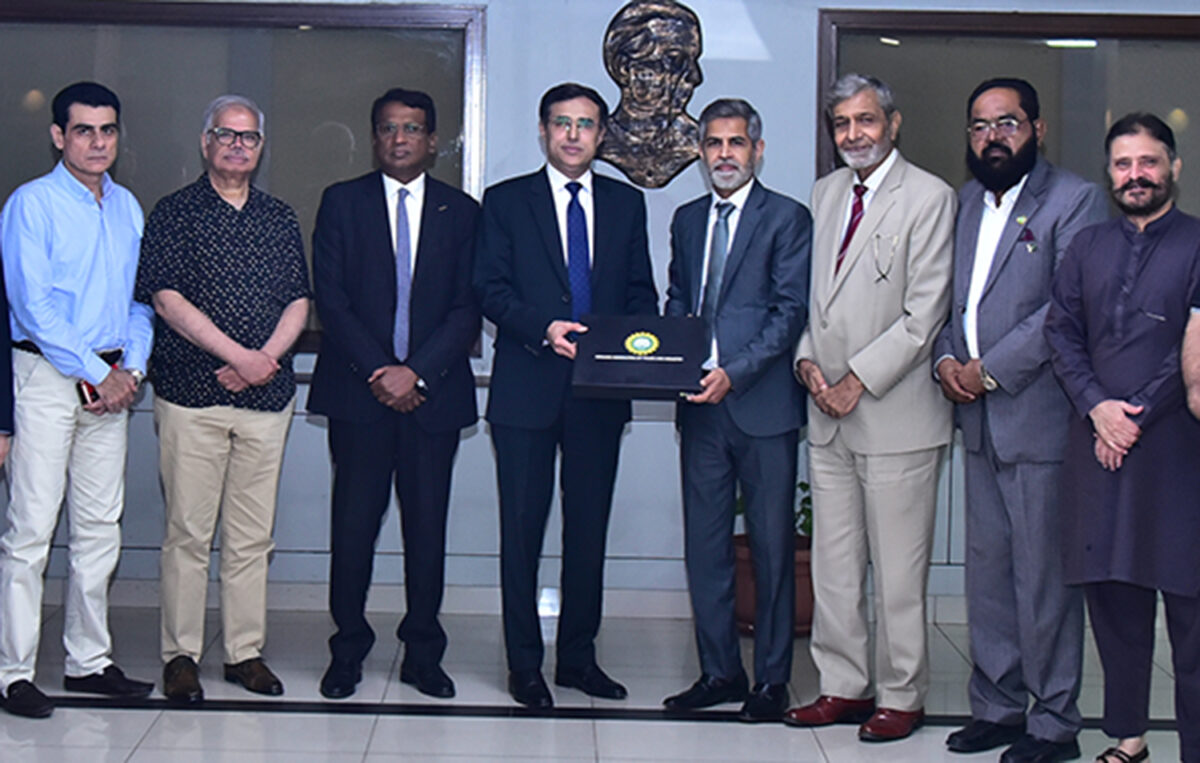

Karachi: Chief Commissioner Inland Revenue, Large Taxpayers Office (LTO) Karachi, Zubair Bilal has stated

that the salaried class can expect some relief in the upcoming federal budget and that the Federal Board of

Revenue (FBR) maintains a zero-tolerance policy against corruption. He made these remarks during his visit

to the Korangi Association of Trade and Industry (KATI), where he addressed a gathering of industrialists and

business leaders.

A large number of KATI members, including President Junaid Naqi, Senior Vice President Ejaz Sheikh, Vice

President Tariq Hussain, Standing Committee Chairman Tariq Malik, former presidents and chairman Farhan-

ur-Rehman, Ehteshamuddin, and Commissioner FBR Abdul Hafeez, were present at the meeting.

Zubair Bilal emphasized that the business community, under KATI’s leadership, should compile and submit

budget proposals to the tax authorities. “We will review the proposals, attach our recommendations, and

forward them to senior officials and policymakers to ensure the budget reflects the needs of the business

community,” he said. He also announced that monthly meetings would be held at KATI to address industry

concerns through mutual consultation.

He stressed that a successful tax policy is one that fosters business growth. “When industries flourish, profits

increase, and tax revenue rises—ultimately benefiting the nation,” he added. He acknowledged that

businesses currently face difficulties complying with the rules and regulations of 58 federal and provincial

agencies and assured the community of full support and accessibility.

Earlier, KATI President Junaid Naqi highlighted major concerns of the business sector, including the lack of a

comprehensive government policy and the pressure on existing taxpayers. “Despite paying taxes, we face

years of recurring complaints, including arbitrary notices and threats of account freezes by FBR officers,” he

said, demanding an end to corruption and more action to broaden the tax base rather than increasing the

burden on compliant taxpayers.

Naqi expressed strong reservations about the amended tax ordinance, particularly provisions that would

allow FBR officials to be stationed within industrial units to monitor production—calling it a serious violation

of constitutional rights. He warned that while the government increases tax targets to satisfy the IMF, the

burden falls entirely on current taxpayers who are already under immense pressure.

Standing Committee Chairman Tariq Malik called for digitization of the tax system to ensure transparency

and quick resolution of complaints. “Those who evade taxes must be held accountable, but the FBR often

treats genuine taxpayers as if they are part of the problem,” he said. Malik emphasized that only a small

segment of the business community is involved in tax evasion and that KATI does not support such elements.

Former Presidents and Chairmen Farhan-ur-Rehman and Ehtishamuddin, along with Senior Vice President

Ejaz Sheikh and other KATI members, also addressed the gathering.