Al Meezan Investments, Pakistan’s Largest & only full-fledged Shariah compliant Asset Management company launched the country’s first Islamic ETF on 6th October 2020 under the moniker Meezan Pakistan Exchange Traded Fund (MP-ETF). The ETF will trade at the stock exchange under the ticker ‘MZNP-ETF’. The product offers significant growth potential due to its transparent nature, low costs and embedded ability to track the index.

MZNP-ETF is an SECP-approved product which consists of a basket of securities which tracks Meezan Pakistan Index (MZNPI) as the underlying benchmark index of the fund. MZNPI tracks approximately 70% of KMI-30, on average. The ETF is available through stockbrokers (TREC Holders) and trade like stocks with real time pricing during trading hours on an exchange. The investor can either trade ETFs like a stock by buying it at a low price and selling it at a high price to make a profit, or can receive dividends from the securities that comprise the ETF basket.

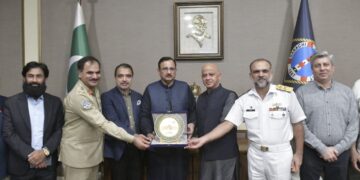

On the occasion of the MZNP-ETF launch ceremony held at PSX, Mohammad Shoaib, CFA, CEO Al Meezan Investments stated “Alhamdulillah, we are extremely excited at the launch of this unique product which has gained massive popularity globally. This will bring about a paradigm shift in the investment attitude of investors who are looking to capitalize on the market movement and liquidity through low cost exchange traded products. We are proud to be the first Islamic ETF in Pakistan with one of the strongest and most diverse investment basket. Looking forward to support from our investors, brokers and media houses to make this endeavor a success In Sha Allah”.

Al Meezan is proud to maintain AM1 rating, which is the highest management quality rating in Pakistan. We also enjoy a unique position of being the only AMC in Pakistan to be awarded the highest management quality rating of AM1 by both VIS & PACRA (Credit Rating Companies). Additionally, we also have the privilege of managing the trust of one of the largest investor base in Pakistan with over 125,000 direct investors and thousands more through the retirement and provident funds being managed by us.