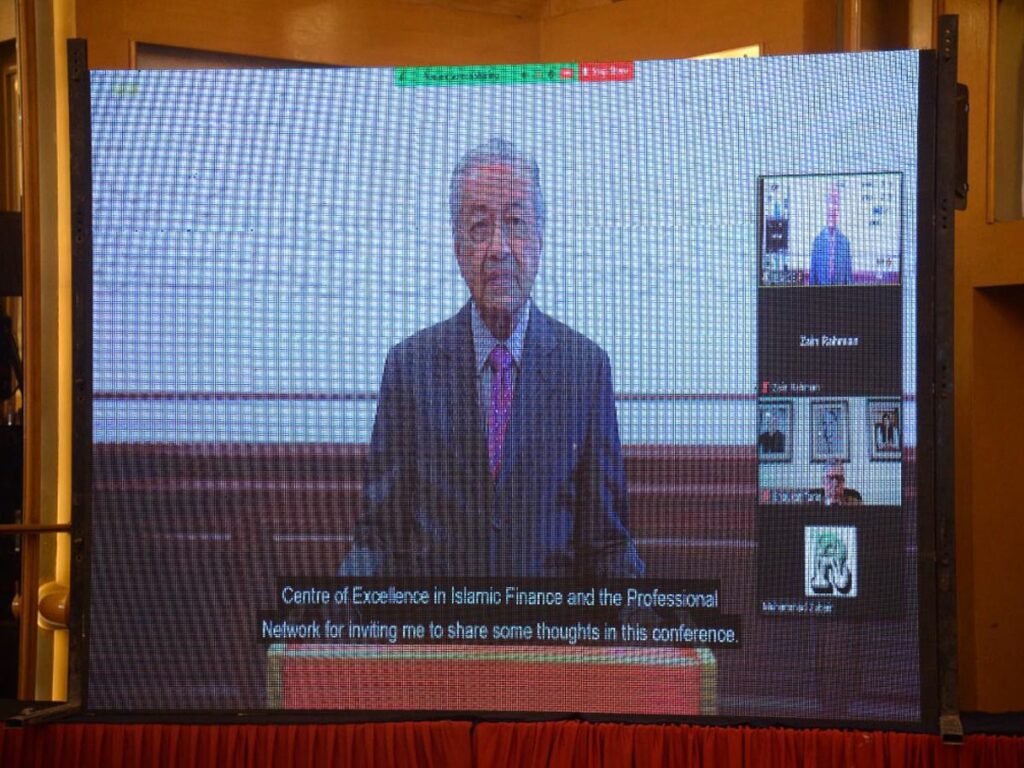

Dr. Mahathir Mohamad former Prime Minister of Malaysia virtually addressed the 10th Islamic Finance Expo and Conference (IFEC) on Tuesday. The conference was New Normal-Digital Transformation & Islamic Economy and was organized by The Professional Network and IBA-CEIF.

Before I precede any further Dr. Mahathir Mohamad first thanks the The Professional Network, IBA-CEIF, and Mr. Mehmood Tareen, Founder & CEO, The Professionals Network, Mr. Irfan Siddiqui, President & CEO, Meezan Bank Ltd., Syed Amir Ali, President & CEO, Banklslami Pakistan Ltd., Ms. Sima Kamil Deputy Governor, SBP, Younus Hussain, President & CEO, Faysal Bank Ltd., Mr. Sirajuddin Aziz, CEO Group Financial Services Habib Bank AG Zurich, and Distinguished guests.

He said I am indeed honoured to be given the opportunity to participate and share some thoughts in this conference. Alas these are the global realities for almost two years now and we have been confined to zoom meeting and virtual conferences. The situation seems to have shown signs of improving and if the trend continues, In ShaAllah.

Further he said numerous participation in international conferences; I’ve often been asked how we transformed Malaysia so that other can perhaps learns from us something that can be of help to you. Offered, we take pride in some of our successes as much as we are ashamed of our failures and shortcomings. Before he share some of our experience in turning Malaysia from an agrarian nation into one that was once categorized as a newly-industrialized country and duded an Asian Tiger, it is important to point out that each nation is unique.

We depended on the export of rubber and tin and these exports were as raw material with any added values. This dependence on the colonial legacy is unavoidable as our post-independence market was per-determined by the colonial masters. Part of that, the former colonial master continued to have the controlling stakes in our rubber plantations and tin mines long after independence.

With a buoyant economy, political stability and progressive society, Malaysia avoided becoming a capitalist nation that only cared for the bottom line. We saw our successes as the success of a Muslim nation and to qualify as one, certain traits must exist.

We gathered some of the best brains from among our Islamic scholars and economists, local and foreign, to look into how we can start introducing Islamic Banking and Financial tools that are Syariah compliant.

Our economic stability gives us credibility to pursue such efforts. We had already set up our Islamic Bank in 1983 but its focus was more on serving local Muslims. It was only a decade later, in 1993 that commercial banks, merchant banks and finance companies were allowed to offer Islamic Bank products and services under the Islamic Banking Scheme.

Even through customers migration to Islamic banking were initially quite slow but it caught on and today in Malaysia, Non-Muslims too had utilized some of the financial tools offered under Islamic banking.

Dr. Mahathir Mohamad further stated that, how to promote the Islamic financial system in Muslims nations and outside. Our experience in Malaysia, such system is accepted only when it offers all kinds of banking services while remaining faithful to the syariah. If a Muslim country is stable both economically and politically, Islamic economic system will continue to grow and transform.