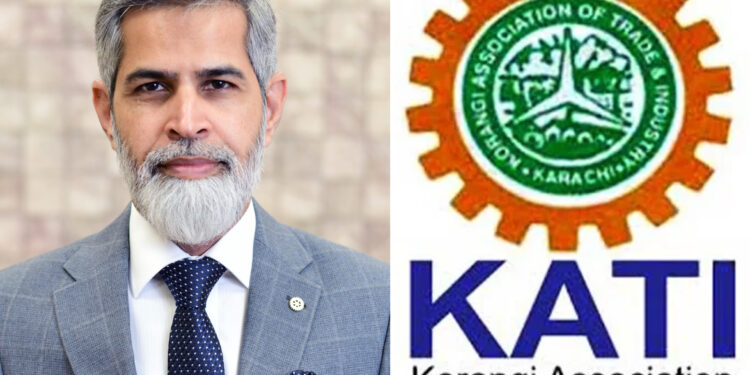

KARACHI: The Korangi Association of Trade and Industry (KATI) President, Junaid Naqi, has expressed

deep disappointment over the State Bank of Pakistan’s decision to maintain the monetary policy rate at

11 percent.

He noted that with inflation currently at a historic low of 3 percent, there was ample room to reduce the

policy rate. “The business community has long demanded a significant cut in the interest rate and its

reduction to single digits, which is crucial to provide relief to the industrial sector,” he said.

Naqi stressed that the high interest rate continues to hurt industrialists and exporters, who are already

struggling with acute capital shortages. He pointed out that Pakistan’s interest rate remains the highest

in the region, creating major hurdles for investment and industrial growth.

Calling the State Bank’s decision “contrary to expectations and difficult to comprehend,” Naqi argued

that a reduction in the policy rate would not only accelerate industrial activity but also significantly

reduce the government’s debt burden, thereby stabilizing the economy and generating employment

opportunities.

“The time has come for a rate cut,” he emphasized, adding that expensive borrowing is pushing up

production costs and eroding the competitiveness of Pakistani products in international markets. He

warned that without cheaper access to finance, exports cannot grow and economic recovery will remain

elusive.

The KATI president urged the government and the central bank to take ground realities into account,

heed the business community’s genuine concerns, and make decisions that support industrial growth

and ensure long-term economic stability.