Exports of 30 billion dollars do not make any sense for a country like Pakistan, ICCI president talks to CEEJ delegation.

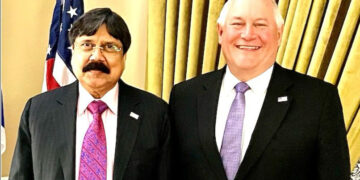

Karachi May 2024: President of Islamabad Chamber of Commerce and Industry (ICCI) Ahsan Bakhtawari has said that businesses under the custody of the government are losing 1500 billion rupees, this is a huge burden on the treasury. They are subsidized, it is of no use, what relief is the public getting from it? Privatization of these institutions should be prioritized in the budget measures, if the country will save 1500 billion rupees, you can divert this money to the construction of health education basic infrastructure. Said during a meeting with a delegation of journalists (CEEJ) during their visit to Islamabad. On this occasion, former presidents of ICCI, Zubair Malik, Zafar Bakhtawari, Khalid Chaudhry, Khalid Iqbal Malik, President CEEJ, Raja Kamran, Secretary Kashif Munir, Secretary Information Masood Ahmed Siddiqui, Vice President. Anjum Alam Wahab, Treasurer Ashraf Khan and others also expressed their views.

President ICCI Ahsan Zafar Bakhtawari said that Islamabad Chamber like other chambers of the country is providing its suggestions to the federal government regarding the preparation of the budget so that they can be made part of the budget, we have given such suggestions to the government. By which trade and industry can be promoted in the country, investment can be accelerated and exports can also increase.

Ahsan Bakhtawari said that the country is in dire need of increasing exports, for a country like Pakistan, exports of 30 billion dollars do not make any sense, a package for exporters should be brought in the budget, reduction of energy cost and cast off in the budget. There should be reduction measures in doing business, domestic exports are not increasing due to two reasons, if we are not able to compete with neighboring countries in the cast of energy, how will we increase exports.

Ahsan Bakhtawari said that the mark-up rate should also come down, the energy mix should be improved, special attention should be paid to increase the power generation, reforms should be made in the discos and electricity theft should be prevented.

He said that bureaucracy is very important in the system of the country, reforms in the bureaucratic system are in dire need of time, the bureaucracy does not cooperate in the implementation of policies, due to which the desired results are not obtained.

He said that Currently, there is talk of Saudi investment in the country, Saudi investment plans of five billion dollars are being made, the bureaucracy will play a very important role in this, but we believe that the representative organizations of the business community of Islamabad, the capital of Pakistan. ICCI should also be taken into confidence.

He said that facilities should be provided for projects in industry, agriculture, IT and other sectors and full confidence should be provided to Saudi investors.

Ahsan Bakhtawari said that the tax collection of FBR is very low, there is no other option without increasing the tax base in the country, the sad thing is that the policies being made to increase the tax net in Pakistan are not effective. Be that as it may, I think that a track and trace system should be installed in all big companies and institutions, which will expose the entire chain from wholesalers to retailers.

He said that one way can be that you don’t sell goods to non-taxpayers, wholesalers or retailers. There are large companies in the country and it is time to install a track and trace system. If it is and works successfully, the revenue will increase manifold, and people will be relieved from heavy taxation.

In response to a question, Ahsan Bakhtawari said that the process of reforms in FBR is very necessary, separation of inland taxes and customs duties, digitization, and interaction with tax payers should be kept to a minimum level. can be brought If the tax authority has a record of each person, then only on the basis of this can any work be done. Many problems in Pakistan are caused due to mistrust, whether it is a small trader or a big industrialist or a big one, no one has any objection to coming into the tax net, the real issue is mistrust. The better the reputation of the tax collection agency, the more people will consider it a privilege to come online.

He said that the farmers in the country gave a huge production of wheat, and when there were reports of a big wheat crop, the import of wheat was allowed at the same time. Such wrong decisions should not be made, due to this policy, the farmers have been discouraged and will suffer,

Ahsan Bakhtawari said that in relation to agriculture, a strategy should be made on the district basis, based on research in the agriculture sector. Production should be done, rice, wheat, cotton, sugarcane and other crops should be cultivated in the relevant districts where they are suitable. If our suggestions are followed by the government, there is no reason why the economy of Billah will once again be on a strong track.