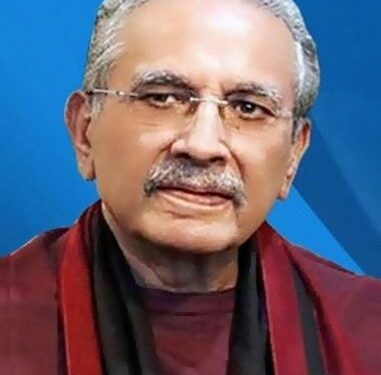

Islamabad : Business leader and former President of the Islamabad Chamber of Commerce and Industry (ICCI), Dr. Shahid Rasheed Butt, said on Sunday lauded the government for taking action against sugar mills involved in tax evasion.

Authorities have started sealing non-compliant sugar mills and suspended nine officials who supported mills evading taxes, which is praiseworthy, he said.

Shahid Rasheed Butt said in a statement issued here today that PM’s directives for improved monitoring of sugar mills to boost revenue and discourage corrupt business practices have worked.

He informed that many tax cheats have been discouraged because of government action, and millions of rupees have been collected in fines from those involved in tax evasion.

Currently, there are five oversight systems in place in the sugar mills. Apart from the Federal Board of Revenue (FBR), the whole process is also being monitored by the Federal Investigation Agency (FIA) and Intelligence Bureau (IB) to ensure transparency in the system, he informed.

The business leader said that FBR personnel have been posted at each mill, and monitoring of the system and personnel through integrated CCTV cameras and frequent visits by senior FBR officers has been ensured.

He added that the Inland Revenue officials are also conducting random checks, and enforcement measures are further augmented by the support of Police and Pakistan Rangers, wherever required.

Shahid Rasheed Butt said that presently there are 80 operational sugar mills in the country producing sugar for local consumption and exports, along with the production and export of molasses and ethanol.

The expected crop of sugarcane in the current year has been estimated at 70 million metric tons, resulting in sugar production in excess of 7 million metric tons.

The opening stock at the start of the crushing season was more than one million metric tons, and current production is adding to the available sugar stock.

He said that the permanent posting of the staff in the sugar mills resulted in controlling the smuggling of sugar, which reduced the prices, and the hoarding of sugar was controlled.

During the current crushing and production season of 2024-25, the FBR has intensified its efforts to ensure compliance with tax laws and has taken strict action against irregularities in sugar mills.

In addition to all the enforcement actions, nine FBR officers who were found to be involved in malpractice and working in connivance with the mills to evade taxes have been suspended based on credible information and reports from the monitoring agencies.

The FBR reiterates its zero-tolerance policy against tax evasion and non-compliance. These actions are part of a broader campaign to enhance tax enforcement in the sugar sector and protect government revenue. Strict monitoring and swift action should continue to ensure adherence to the law.

Mr. Butt demanded that FBR should also tighten the noose against ghee and vegetable oil manufacturers and other influential sectors that are stealing taxes worth billions of rupees which is keeping the country poor and dependent on loans.