Pakistan’s Economic Lifeline:

The Three Pillars of Survival —

Remittances, Strategic Military Support, and Foreign & Domestic Loans

By Dr. Gholam Mujtaba

Pakistan’s economic image is increasingly defined by reliance on three critical external pillars rather than firm domestic productivity.

These three support systems are: (1) diaspora remittances, (2) strategic and military backing from the United States, and (3) a growing mix of external and domestic loans. Here is a detailed overview of how these elements are shaping the Pakistani economy and what they reveal about the country’s structural challenges.

The Budget and Remittances

According to recent data, Pakistan’s federal budget for FY 2025-26 has a total outlay of about Rs 17.57 trillion (roughly US $62-63 billion) in nominal terms.¹

Simultaneously, workers’ remittances from overseas Pakistanis reached approximately US $31.2 billion in the first ten months of FY 2025, with projections of up to around US $38 billion for the full year.²

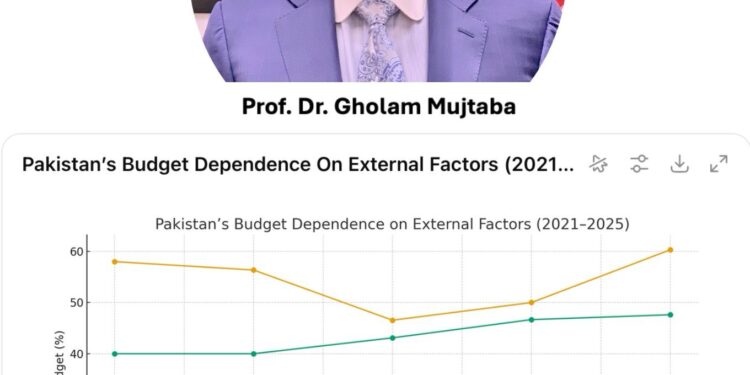

That means remittances alone could make up over 60% of the annual budget size (in dollar terms)—showing how much of Pakistan’s fiscal space is supported by the diaspora.

U.S. Strategic and Military Support

Over the long term, the United States has provided significant military and economic aid to Pakistan due to its geopolitical importance, particularly through Afghanistan and regional security. Historical records show that between 1951 and 2011, the U.S. committed approximately USD $67 billion (in constant 2011 dollars) in combined military and economic assistance to Pakistan. Although specific recent details about “covert operations” remain classified or unclear, the implication is that part of Pakistan’s strategic aid income is undisclosed. This element acts as a second oxygen cylinder: strategic military support rather than just economic aid, which helps fuel budget relief.

Domestic and Foreign Borrowing

The third and most alarming dependency is on borrowing.

* By the end of March 2025, Pakistan’s total public debt (domestic plus external) was about Rs 76,007 billion (approximately US $272 billion at a rough conversion rate), of which Rs 51,518 billion (~US $184 billion) was domestic debt.?

* Domestic debt totaling Rs 51,518 billion (~$184 billion) indicates that more than two-thirds of the public debt burden is owed to domestic creditors.

* Regarding new flows: recent government domestic borrowing auctions indicate acceptance of roughly Rs 9.47 trillion in treasury bills, Rs 9.68 trillion in PIBs, and Rs 1.56 trillion in Sukuk during one review period — from a much larger total bid pool.

* Additionally, in June 2025, Pakistan agreed to a domestic loan of about Rs 1.275 trillion (roughly US $4.5 billion) with local banks to ease power-sector debt, with planned annual repayments of Rs 323 billion. To put this into perspective: Pakistan appears to be taking on domestic financing obligations of around US $4-5 billion each year, along with sizable treasury and bond auctions worth many billions of dollars more. With domestic debt of approximately US$184 billion, even a “modest” annual new borrowing of US$5 billion, plus the rolling over of existing debt, creates a significant financing challenge.

In summary: Pakistan’s economy depends on borrowing from domestic banks and foreign lenders to bridge fiscal gaps—not on robust export or industrial growth.

The Big Picture

When we put all three cylinders together:

1. Diaspora remittances: approximately US $38 billion expected this year.

2. U.S. strategic military support: over a hundred billion dollars in history, including implied covert flows.

3. Borrowing: domestic debt stock around US$184 billion; annual new borrowing flows of several billion USD (approximately US$4-5 billion from domestic loan facilities alone, plus other securities auctions).

This triangulation reveals the economy’s heavy dependence on external sources rather than a domestic engine. Pakistan’s ability to fund its budget, service its debt, and maintain macro-stability depends more on these external supports than on strong growth in manufacturing, textiles, or export sectors.

Implications and Outlook

* The dominance of remittances means economic growth is disconnected from industrial or export performance; it also makes the country susceptible to external shocks (such as global labor demand or currency fluctuations).

* Reliance on strategic and military support links the economy to geopolitical changes. If this support declines, the fiscal gap will grow.

* Heavy domestic borrowing crowds out private investment by competing with the government for bank funds and increases systemic risk: when banks hold most government debt, a debt shock can destabilize the banking system.?

* Given the weak domestic industrial base, the decline in key sectors such as textiles, and the decline in foreign investment, the capacity to generate export earnings sufficient to reduce borrowing is very limited.

* The economy’s survival on “oxygen cylinders” indicates that without urgent reforms to increase domestic productivity, diversify financing sources, and rebuild investor confidence, Pakistan risks falling into a credit-dependent trap.

In summary, Pakistan’s economic image today does not depict a rising industrial exporter, but rather a strategically leveraged, heavily dependent state, relying on three fragile supports. Without decisive changes in domestic performance and export focus, the economic model appears increasingly unstable.

References

1. Pakistan’s Federal Budget outlay FY 2025-26: ~Rs 17.57 trillion ? US $62-63 billion. State Bank of Pakistan+2State Bank of Pakistan+2

2. Workers’ remittances: US $31.2 billion first 10 months FY 2025; projected up to US $38 billion. IMF+2Finance Division+2

3. U.S. military and economic aid to Pakistan 1951-2011 ~US $67 billion (constant 2011 $). IMF+2IMF+2

4. Total public debt end-March 2025: Rs 76,007 billion; domestic debt Rs 51,518 billion. Finance Division

5. Domestic debt share: Rs 51,518 billion (~US $184 billion) of total about Rs 76,007 billion. Finance Division

6. Domestic securities auction acceptances: treasury bills Rs 9.473 trillion, PIBs Rs 9.682 trillion, Sukuk Rs 1.562 trillion. The Express Tribune

7. Domestic loan facility with local banks: Rs 1.275 trillion (~US $4.5 billion) with annual repayment Rs 323 billion. Arab News+1

8. Nearly 60 % of government domestic debt held by banks; sovereign-bank nexus risk. Atlantic Council+1

Author Introduction

Dr. Gholam Mujtaba is a Pakistani American political leader and scholar. Holding dual doctoral degrees (MD and Ed.D.) with a focus on leadership studies, he serves as Chairman of the Pakistan Policy Institute USA and as a senior advisor within U.S.–Pakistan strategic forums. A loyal Pakistani American and dedicated Republican, Dr. Mujtaba offers a nuanced understanding of South Asia’s geopolitics and Pakistan’s civil–military relations in his commentary.