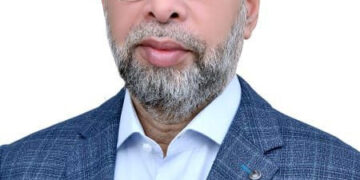

KARACHI – Patron of SITE Association of Industry Zubair Motiwala has once again drawn the attention of the federal government towards the difficulties being faced due to inability of fully automated sales tax refund system (FASTER) by Five Zero Rated Export Sectors namely Value Added Textile, Sports Goods, Surgical goods, Leather and Carpet and demanded ‘No Tax No Refund’ Regime through the revival of SRO-1125.

In a statement, Zubair Motiwala said that FBR declared these five export sectors as zero-rated sectors under SRO-1125 on which, sale tax was charged at zero-rate but unfortunately, this facility was withdrawn in the last budget. Re-imposition of sales tax has compelled the foreign buyers to shift order to other regional competing countries, which will drastically hurt our economy and the tax has put an extra burden in the manufacturing of these sectors.

“These export sectors were already facing severe liquidity crunch prior to corona virus regime due to their stuck up sales tax refunds, income tax refunds, custom rebates and DLTL and DDT payments. Now the closure of industries together with cancellation of large number of export orders have literally brought these industries at the verge of collapse.”, he pointed out.

Motiwala further said that it is high time to declare this in the upcoming budget 2020-21 and fulfill the long outstanding demand of value-added export sectors to restore ‘No Tax No Refund’ Regime.

He demanded Prime Minister Imran Khan to consider this on a priority basis in the wake of the current corona pandemic situation and order the immediate restoration of the ‘No Tax No Refund’ system.