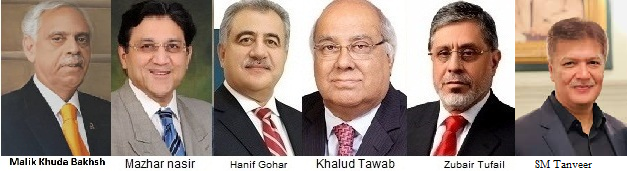

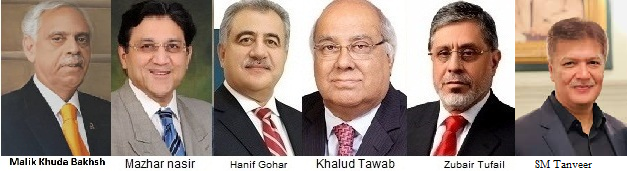

Karachi (05-11-2024) The leadership of the United Business Group (UBG), including Chief Patron SM Tanveer, President Zubair Tufail, Chairman of Sindh Region Khalid Tawab, General Secretary Hanif Goher, and core committee members Syed Mazhar Ali Nasir and Malik Khuda Bakhsh, welcomed the State Bank of Pakistan’s decision to reduce the interest rate by 2.5% to 15%. They expressed the hope that the government and the State Bank will ensure that by the start of 2025, the interest rate will be brought down to a single-digit figure.

SM Tanveer, Chief Patron of UBG, stated that the government is on the right path, and this decision reflects the government’s willingness to listen to the concerns of the business community, which is represented by FPCCI. Tanveer further added that this reduction in interest rates will provide much-needed relief to the private sector, which will help boost economic growth. He emphasized that while progress has been made, there is still much to be done, and the private sector is urging the government to further reduce the interest rate. The target is to bring it down to 12.5% by December 31st and further to 8-9% by June 2025. He expressed confidence that reducing the interest rate to this level will enable businesses to thrive, create jobs, and contribute to the country’s economic prosperity.

Zubair Tufail, President of UBG, stated that the 2.5% reduction in the interest rate will make the industrial sector more competitive compared to other countries. He pointed out that given the reduction in inflation, which the State Bank itself acknowledges, further cuts in interest rates are feasible. He expressed hope that by the end of December, the government would reduce the rate by another 2.5 to 3%. Tufail emphasized that the business community desires a single-digit interest rate, which will encourage borrowing and reduce business costs, ultimately promoting industrial growth and benefiting the economy.

Khalid Tawab and Hanif Goher stated that while the 2.5% reduction is a positive step, bringing the interest rate down to the 5-7% range, in line with regional and global levels, would significantly improve the business climate and further reduce inflation. Syed Mazhar Ali Nasir and Malik Khuda Bakhsh added that the recent reduction in the interest rate will encourage economic growth, but they called for an additional 3% reduction by the end of the year, as the current high interest rates are preventing a reduction in business costs and are causing severe difficulties for exporters and industrialists. They acknowledged that the recent 2.5% reduction is a welcome development.