April 14, 2025 : The inaugural ceremony of Pakistan Financial Literacy Week (PFLW) 2025 was held today at the National Institute of Banking and Finance (NIBAF) Pakistan–Karachi. The event brought together key stakeholders from across the financial sector to promote the importance of financial education and inclusive growth under the theme “Financial Inclusion through Collaboration and Innovation.”

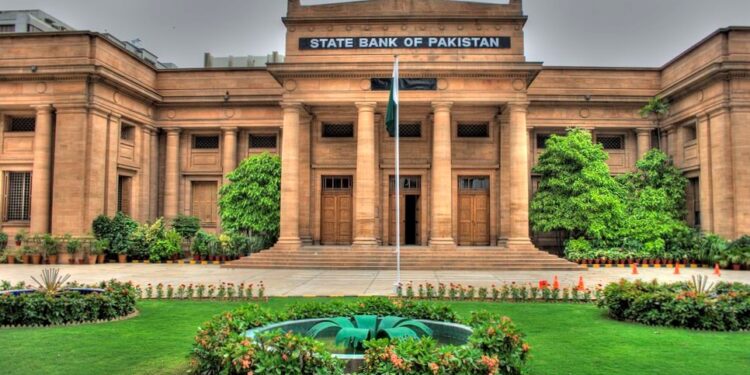

Governor State Bank of Pakistan (SBP) graced the occasion as the Chief Guest and delivered the keynote address. A key highlight of the event was the launch of the National Financial Education Roadmap, unveiled by the Governor SBP. This strategic document outlines Pakistan’s vision and actionable framework to expand the knowledge and access to quality financial services for all segments of society.

Mr. Ahmad emphasized the crucial role of financial literacy in building a more inclusive and resilient financial system. He highlighted SBP`s efforts towards increasing the numbers of financial inclusion in the country and appreciated banking industry and other stakeholders for their role in financial literacy efforts. The Pakistan Financial Literacy Week 2025 will continue through April 18, 2025, featuring a wide range of activities including awareness campaigns, financial education sessions, school outreach programs, digital engagement initiatives and financial literacy walks across the country.

During the speech, Governor said that Pakistan has made significant strides in promoting financial inclusion through a range of initiatives. He elaborated that the National Financial Literacy Program for Adults and Youth has successfully trained over 3.4 million individuals, with women making up 58% of the participants. A specialized financial literacy program for teachers in Baluchistan has also been launched, aimed at empowering the teaching community in historically underserved regions. Referring to Banking on Equality Policy (BoE), he observed that the policy has played a key role in reducing the gender gap in financial access—from 47% in 2018 to 34% in 2023. Additionally, the launch of Raast, Pakistan’s first instant digital payment system, has facilitated fast, secure, and low-cost transactions for the public. Complementing this, the Asaan Digital Account and Asaan Mobile Account have made it easier for millions to open bank accounts and access digital financial services.

Furthermore, to recognize outstanding contributions in advancing financial education, inclusion and innovation, awards were presented to banks and institutions demonstrating exceptional performance in areas of financial literacy outreach, Financial Inclusion and women’s financial inclusion, and digital innovation.

The ceremony was attended by Chairperson of the Pakistan Stock Exchange (PSX), senior officials from SBP and SBP-BSC, and high-level representatives from the Pakistan Security Printing Corporation (PSPC), the Securities and Exchange Commission of Pakistan (SECP), the Asian Development Bank (ADB), and other international and domestic stakeholders. Presidents and CEOs of leading banks, along with dignitaries from across the financial and development sectors, also participated, reflecting a strong commitment to advancing the cause of financial literacy nationwide.