ISLAMABAD, May 26, 2025: The Ministry of Finance (MoF), in collaboration with Karandaaz Pakistan and the Pakistan Banks Association (PBA), is hosting a two-day training workshop titled “From Value to Vision: Financing with Purpose from Pakistan’s Financial Sector” in Islamabad on May 26–27, 2025. The event has brought together senior representatives from Pakistan’s financial sector, including commercial banks, development finance institutions (DFIs), regulators, and investment experts, to explore the integration of impact financing principles into mainstream financial operations.

The training was inaugurated by Senator Muhammad Aurangzeb, Federal Minister for Finance and Revenue, who emphasized the government's commitment to innovative and inclusive financial solutions. He noted that, recognizing the urgency of resource allocation for key sectors, the Prime Minister had constituted a Committee on Social Impact Financing. This committee was tasked with charting a new course for sustainable and inclusive financial innovation. As a result, the committee developed the Social Impact Financing Framework, a strategic blueprint aimed at prioritizing developmental needs and mobilizing both public and private capital in alignment with the Sustainable Development Goals (SDGs). The framework encourages the creation of innovative financial instruments that balance financial returns with measurable social and developmental outcomes, thereby aligning investment flows with national priorities. The finance minister called on the training participants to leverage this upskilling program to adopt international best practices in impact measurement, prioritize the country’s developmental needs in their financing products, and embed impact outcomes into their operational frameworks.

Speaking about the importance of the initiative, Syed Salim Raza, Chairperson Karandaaz, said: “Karandaaz is proud to support Pakistan’s financial sector as it transitions toward purpose-driven finance. This training is part of our broader commitment to building the institutional capacity required to align with global investment standards and deliver measurable development outcomes.

By strengthening local capabilities in impact measurement and sustainable finance, we are laying the

foundation for a more inclusive and resilient financial system.”

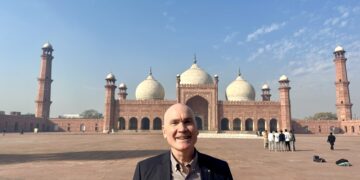

Addressing to the participants, Director Development BHC Islamabad, Jo Moir stated “This training

underscores BHC’s long-term engagement with Pakistan’s financial sector. A decade ago, we supported the creation of Karandaaz as a special purpose impact finance vehicle. Today, it serves as a lighthouse for the sector, demonstrating scalable models for inclusive and sustainable finance.” The workshop is being led by Alex MacGillivray, Executive Director at the JIM Foundation and a globally recognized expert in impact measurement. With a career spanning development finance institutions and advisory work international impact investors, MacGillivray has delivered a highly practical curriculum that blended theory with real-world applications.

“The idea was to move beyond traditional credit models and introduce a more purposeful financing

approach, one that drives measurable outcomes alongside financial returns,” said MacGillivray.

“With the right institutional momentum and leadership, Pakistan can play a key role in the global

impact investing movement.”

The training is covering a comprehensive range of topics, including strategic intent, impact governance, portfolio-level impact design, impact at exit and independent validation. Participants are engaging in interactive case studies, peer learning sessions, and scenario-based exercises aimed at translating concepts into actionable strategies.

The event is being attended by over 40 senior professionals from across Pakistan’s financial ecosystem. Representatives from the State Bank of Pakistan (SBP), (Security and Exchange Commission of Pakistan (SECP), leading commercial banks, and development finance institutions are actively contributing to discussions on how impact-linked strategies can align with national priorities such as climate resilience, financial inclusion, and private sector socioeconomic growth.

Articulating the sector’s commitment to sustainable finance, Muneer Kamal, CEO & Secretary General PBA, said, “Pakistan’s banking sector must lead from the front as we transition towards a more sustainable and impact-driven financial ecosystem. This partnership with MoF and Karandaaz reflects PBA's commitment to strengthening sectoral readiness and aligning capital with long-term national priorities." This training reinforces the commitment by MoF, Karandaaz and PBA’s ongoing efforts to strengthen institutional capabilities in Pakistan’s financial sector and support the country’s transition toward sustainable, impact-oriented finance. As global standards for responsible investing continue to evolve, Karandaaz remains committed to equipping local actors with the tools and knowledge needed to access and manage development capital effectively.