Elder fraud complaints to the FBI’s Internet Crime Complaint Center (or IC3) increased by 14% in 2023, and associated losses increased by about 11%, according to IC3’s 2023 Elder Fraud Report, released April 30.

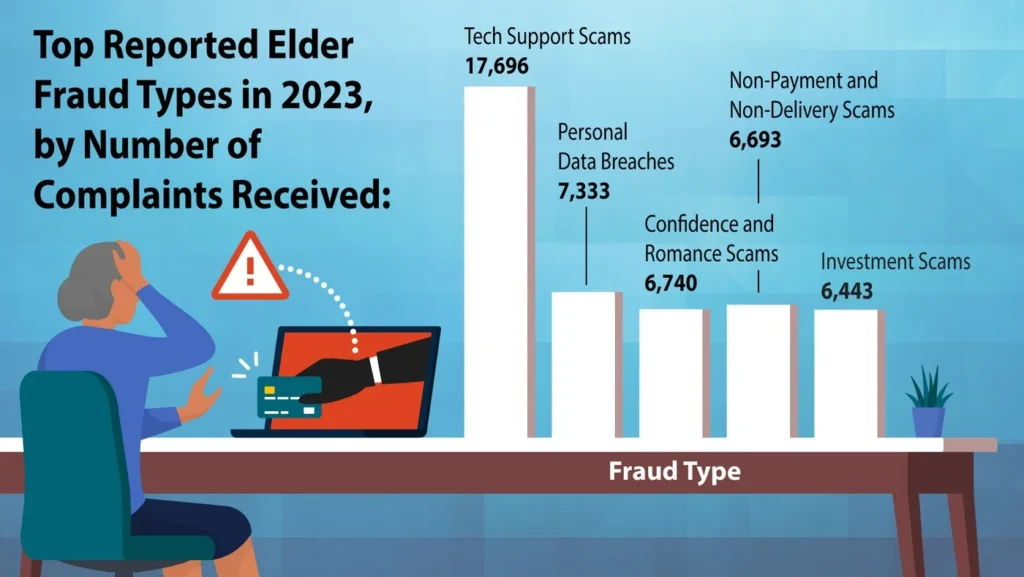

This annual publication provides statistics about incidents of elder fraud—or fraud that explicitly targets older Americans’ money or cryptocurrency—that are reported to IC3. The report aims to raise the public’s awareness of this issue and to prevent future and repeat incidents. “Combatting the financial exploitation of those over 60 years of age continues to be a priority of the FBI,” wrote FBI Assistant Director Michael D. Nordwall, who leads the Bureau’s Criminal Investigative Division, in the report. “Along with our partners, we continually work to aid victims and to identify and investigate the individuals and criminal organizations that perpetrate these schemes and target the elderly.” And elder fraud is probably a more insidious threat than the report shows. Many of these crimes likely go unreported, and, as the report states, “only about half” of the fraud scam complaints submitted to IC3 in 2023 included victims’ ages.Here are five key takeaways from the 2023 report: 1. Elder fraud is an expensive crime. Scams targeting individuals aged 60 and older caused over $3.4 billion in losses in 2023—an increase of approximately 11% from the year prior. The average victim of elder fraud lost $33,915 due to these crimes in 2023. 2. Older Americans seem to be disproportionately impacted by scams and fraud. Over 101,000 victims aged 60 and over reported this kind of crime to IC3 in 2023. On the flip side, victims under the age of 20 years old seemed to be the least-impacted demographic, with about 18,000 victims in this demographic reporting suspected scams or frauds to IC3 last year. 3. Tech support scams were the most widely reported kind of elder fraud in 2023. Nearly 18,000 victims aged 60 and over reported such scams to IC3. Personal data breaches, confidence and romance scams, non-payment or non-delivery scams, and investment scams rounded out the top five most common types of elder fraud reported to IC3 last year.

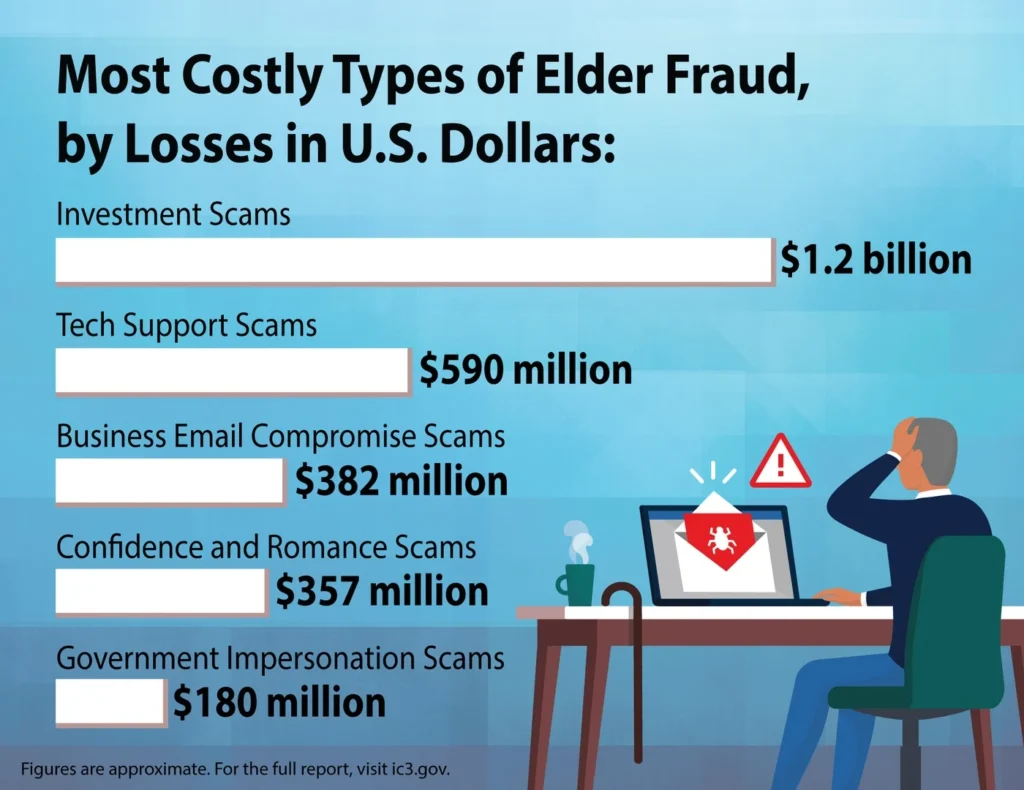

4. Investment scams were the costliest kind of elder fraud in 2023. These schemes cost victims more than $1.2 billion in losses last year. And tech support scams, business email compromise scams, confidence and romance scams, government impersonation scams, and personal data breaches all respectively cost victims hundreds of millions of dollars in 2023.

5. Scammers are coming for people’s cryptocurrency. More than 12,000 victims aged 60 and over indicated that cryptocurrency was “a medium or tool used to facilitate” the scam or fraud that targeted them when reporting it to IC3.

Read IC3’s full 2023 Elder Fraud Report to see more statistics from last year.

If you or someone you know may have been a victim of elder fraud, contact your local FBI field office or submit a tip online at tips.fbi.gov. If the suspected fraud was internet-facilitated, you can also file a complaint with the FBI’s Internet Crime Complaint Center at ic3.gov.