Karachi, [Monday, July 22, 2024] – Dubai Islamic Bank Pakistan Limited (DIBPL), a subsidiary of

Dubai Islamic Bank, has partnered with ZLK Islamic Financial Services, Pakistan’s first Shariah-

compliant brokerage firm. The MoU signing ceremony was held at DIBPL Head Office in Karachi. The

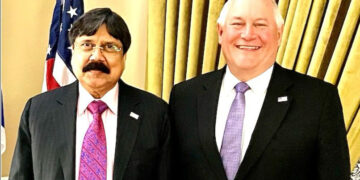

MOU was signed by Junaid Ahmed, CEO of DIBPL, and Zahid Latif Khan, Chairman of ZLK Islamic

Financial Services, in the presence of Ashfaq Ahmad Khan, COO of ZLK Financial Services, and Naveed

Malik, Head of Consumer Banking at DIBPL.

This strategic collaboration is aimed at enhancing access to Shariah-compliant financial products for

DIBPL’s wide customer base, including Roshan Digital Account holders and local clients. Customers are

set to gain access to brokerage services by investing in a variety of Riba-free financial products such as

shares, GoP Ijaras Sukuk, ETFs, and Murabaha Share Financing (MSF). This initiative is a testament to

DIBPL and ZLK Islamic Financial Services’ commitment to promoting and expanding ethical and

Shariah-compliant financial solutions in Pakistan.

Mr. Junaid Ahmed, CEO, DIBPL, commented: “DIBPL remains committed towards initiating and

promoting innovative Islamic banking solutions. This collaboration with ZLK Islamic Financial Services

highlights our dedication to expanding access to creative financial products, promoting financial inclusion

and prosperity.”

Mr. Naveed Malik, Head of Consumer Banking, DIBPL, added: “Our partnership with ZLK is designed

to help customers achieve Halal Munafa (returns) on their investments. At DIBPL, we provide Shariah-

compliant investment opportunities, enabling our customers to engage in financial activities that promote

both financial inclusion and Shariah-compliant banking services.”

Mr. Zahid Latif Khan, Chairman, ZLK Islamic Financial Services, emphasized the strategic importance of

the partnership, stating: “We are excited to partner with DIBPL to enhance our brokerage services and

provide clients with seamless access to Shariah-compliant investment opportunities. Together, we will

deliver value-added solutions that meet the globally accepted standards of Islamic finance.”

Through this partnership, DIBPL and ZLK Islamic Financial Services aspire to foster a conducive

ecosystem for Shariah-compliant finance, contributing to the sustainable growth and development of

Pakistan’s Islamic financing sector.