Karachi – December 19, 2023: U Microfinance Bank (U Bank), one of the largest microfinance banks in

Pakistan, has forged a strategic partnership with Bank Alfalah Limited, one of the country’s largest

commercial banks, to secure a short-term financing facility of PKR 10 billion aimed to collaboratively

facilitate U Bank’s corporate funding.

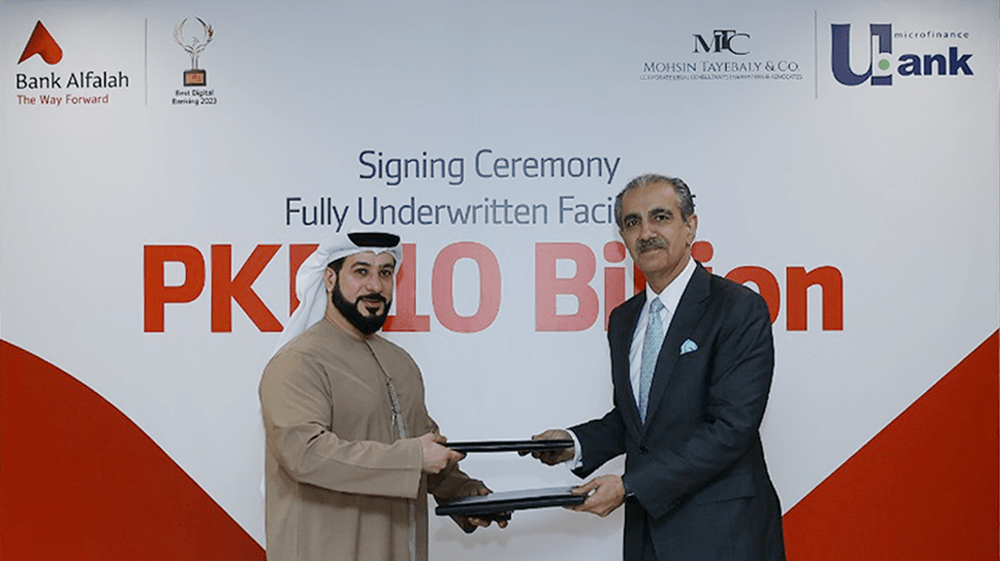

The collaboration was officiated in a formal ceremony held recently in Karachi, where Mr. Mohamed

Essa Al Taheri, President & CEO – U Bank, and Mr. Atif Bajwa, President & CEO – Bank Alfalah,

signed a Memorandum of Understanding in the presence of key management representatives from both

the organizations. The ceremony underlined resilience and harmony within the financial sector in Pakistan

and signified a collective effort to drive positive change and a shared commitment towards financial

inclusion.

Mr. Mohamed Essa Al Taheri, President and CEO – U Bank, spoke about the collaboration: “We are

delighted to enter into this strategic alliance with Bank Alfalah that significantly contributes to our efforts

towards offering inclusive financial products and services to the underbanked population, expanding our

outreach further to more regions of Pakistan, and driving overall economic development in the country.

At U Bank, we work towards creating real and meaningful impact in communities we serve, and this

collaboration enables us to achieve that.”

Mr. Atif Bajwa, President and CEO – Bank Alfalah, expressed on the collaboration: “The extension of

this fully underwritten facility seeks to strengthen our partnership with U Microfinance Bank and reflects

our commitment to promote financial inclusion in Pakistan. Our shared goal is to ultimately empower

underserved communities and drive inclusive economic growth.”

The partnership signifies a pivotal move to strengthen relations between the two banks and to enhance U

Bank’s efforts towards financial inclusion in Pakistan. With this financing facility, U Bank aims to fortify

its endeavors towards further building the microfinance sector in Pakistan and pursue strategic initiatives

that contribute to the bank’s sustained growth. Bank Alfalah’s role in providing a PKR 10 Billion facility

highlights its commitment to supporting key players in the financial sector, aligning with its broader

strategy of fostering growth in banking in Pakistan. This collaboration stands as a testament to the

dynamic and cooperative spirit within the local banking industry, and sets a precedent for future synergies

that enable collective progress.