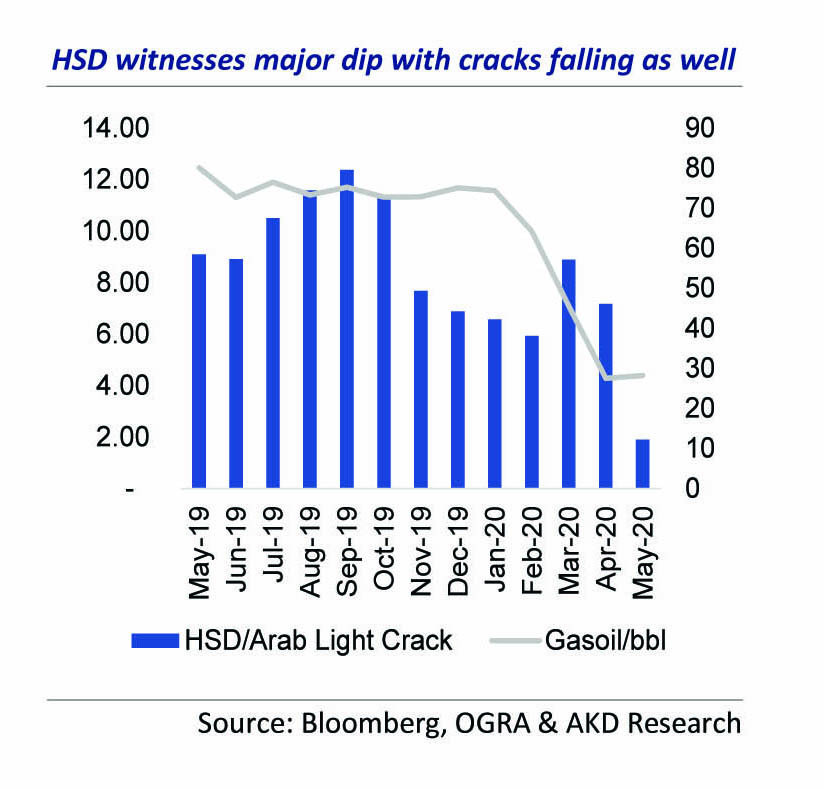

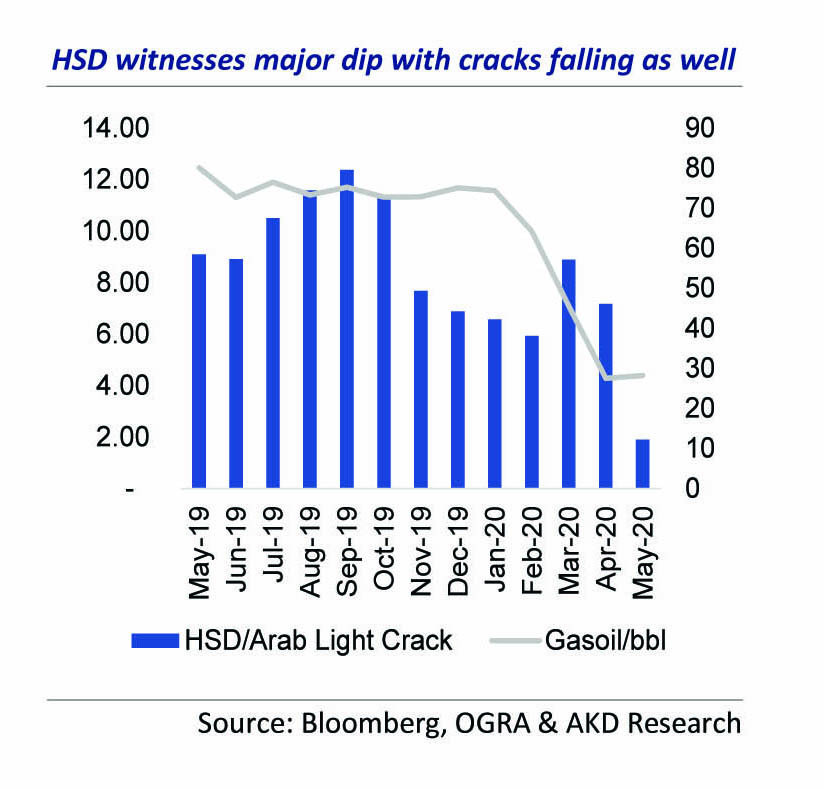

- POL product cracks moved erratically during May-20, aided by limited upsides priced into the demand scenario and underlying crude benchmarks recovering (May-20/FY20TD Arab light Average of US$26.3/54.1/bbl), as May-20 HSD/MS crack to Arab Light for the month averaged US$+1.9/-1.7/bbl standing below FY20TD average of US$+8.3/+US$1.1/bbl, where HSD cracks slipped drastically (-74%MoM) during the month

- HSFO cracks retraced back to 3QCY19 levels falling 7.8xMoM to US$-5.5/bbl, where global industrial demand (April-20 PMIs at all-time lows), container traffic (falling despite Chinese ports restarting operations) are likely to keep margin recoveries short-lived, while among major product spreads, MS crack to Arab Light rose 70%MoM

- As global economic activity shows initial signs of recovery and economic priorities drive long term policy responses to COVID-19 pandemics (particularly developing and low income economies), Asian POL product demand is expected to drive refined fuel demand higher, where recovery in HSD margins is much needed for rescuing refining margins (HSD constitutes 43% of 8MFY20 refining output)

- With about 48% of cumulative refining output at gross loss (MS/FO constitute 22/26% of 8MFY20 output), refinery output is expected to remain limited. A comparison of recent correlations between international POL benchmarks and ex-refinery pricing for HSFO/HSD/MS shows rising correlations over FY20TD vs. 3YR hist. avg., implying US$ stability as the key lever for keeping domestic POL prices low.

Not all recoveries are the same: Even before the impact of the N-COV 19 outbreak rattled markets, outlook for refined fuel demand seems bleak, with major Asian markets undergoing a period of lower demand for transportation fuels and IMO 2020 keeping a lid on HSFO benchmarks POL product cracks moved erratically during May’20, aided by limited upsides priced into the demand scenario and underlying crude benchmarks recovering (May’20/FY20TD Arab light Aver-age of US$26.3/54.1/bbl), as May’20 HSD/MS crack to Arab Light for the month averaged US$+1.9/-1.7/bbl standing below FY20TD average of US$+8.3/+US$1.1/bbl, where HSD cracks slipped drastically (-74%MoM) during the month. HSFO cracks retraced back to 3QCY19 levels falling 7.8xMoM to US$-5.5/bbl, where global industrial demand (April’20 PMIs at all-time lows), container traffic (falling despite Chinese ports restarting operations) are likely to keep margin recoveries short-lived, while amongst major product spreads, MS crack to Arab Light rose 70%MoM

Outlook: As global economic activity shows initial signs of recovery and economic priorities drive long term policy responses to COVID-19 pandemics (particularly developing and low in-come economies). With about 48% of cumulative refining output at gross loss (MS/FO constitute 22/26% of 8MFY20 output), refinery output is expected to remain limited. A comparison of re-cent correlations between international POL benchmarks and ex-refinery pricing for HSFO/HSD/MS shows rising correlations over FY20TD vs. 3YR hist. avg., implying US$ stability as the key lever for keeping domestic POL prices low.

Disclosure Section

Neither the information nor any opinion expressed herein constitutes an offer or a solicitation of an offer to transact in any securities or other financial instrument and is for the personal information of the recipient containing general information only. AKD Securities Limited (hereinafter referred as AKDS) is not soliciting any action based upon it. This report is not intended to provide personal investment advice nor does it provide individually tailored investment advice. This report does not take into account the specific investment objectives, financial situation/financial circumstances and the particular needs of any specific person. Investors should seek financial advice regarding the appropriateness of investing in financial instruments and implementing investment strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. AKDS recommends that investors independently evaluate particular investments and strategies and it encourages investors to seek the advice of a financial advisor.

The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives. The securities or strategies discussed in this report may not be suitable for all investors, and certain investors may not be eligible to purchase or participate in some or all of them.

Reports prepared by AKDS research personnel are based on public information. AKDS makes every effort to use reliable, comprehensive information, but we make no representation that it is accurate or complete. Facts and views presented in this report have not been reviewed by and may not reflect information known to professionals in other business areas of AKDS including investment banking personnel. AKDS has established information barriers between certain business groups maintaining complete independence of this research report.

This report has been prepared independently of any issuer of securities mentioned herein and not in connection with any proposed offering of securities or as agent of any issuer of any securities. Neither AKDS, nor any of its affiliates or their research analysts has any authority whatsoever to make any representation or warranty on behalf of the issuer(s). AKDS Research Policy prohibits research personnel from disclosing a recommendation, investment rating, or investment thesis for review by an issuer prior to the publication of a research report containing such rating, recommendation or investment thesis.

We have taken all reasonable care to ensure that the information contained herein is accurate, up to date, and complies with all prevailing Pakistani legislations. However, no liability can be accepted for any errors or omissions, or for any loss resulting from the use of the information provided as any data and research material provided ahead of an investment decision are for information purposes only. We shall not be liable for any errors in the provision of this information, or for any actions taken in reliance thereon. We reserve the right to amend, alter, or withdraw any of the information contained in these pages at any time and without no-tice. No liability is accepted for such changes.

Stock Ratings

Investors should carefully read the definitions of all ratings used in each research report. In addition, research reports contain information carrying the analyst’s view and investors should carefully read the entire research report and not infer its contents from the rating ascribed by the analyst. In any case, ratings or research should not be used or relied upon as investment advice. An investor’s decision to buy, sell or hold a stock should depend on individual circumstances and other considerations. AKDS uses a three tier rating system: i) Buy, ii) Neutral and iii) Sell with total returns (capital upside + dividend yield) benchmarked against the expected one year forward floating (variable) risk free rate (10yr PIB) plus risk premium.

Valuation Methodology

To arrive at our period end target prices, AKDS uses different valuation techniques including:

- Discounted Cash Flow (DCF, DDM)

- Relative Valuation (P/E, P/B, P/S etc.)

- Equity & Asset return based methodologies (EVA, Residual Income etc.)

Analyst Certification of Independence

The analysts hereby certify that their views about the companies and their securities discussed in this report are accurately expressed and that they have not received and will not receive direct or indirect compensation in exchange for expressing specific recommendations or views in this report.

The research analysts, strategists or research associates principally having received compensation responsible for the preparation of this AKDS research report based upon various factors including quality of research, investor client feedback, stock picking, competitive factors and firm revenues.

Disclosure of Interest Area

AKDS and the authoring analyst do not have any interest in any companies recommended in this research report irrespective of the fact that AKD Securities Limited may have, within the last three years, served as manager or co-manager of a public offering of securities for, or currently may make a primary market in issues of, any or all of the entities mentioned in this report or may be providing, or have provided within the previous 12 months, significant advice or investment services in relation to the investment concerned or a related investment.

Regional Disclosures (Outside Pakistan)

The information provided in this report and the report itself is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject AKDS or its affiliates to any registration or licensing requirements within such jurisdiction or country.

Furthermore, all copyrights, patents, intellectual and other property in the information contained in this report are held by AKDS. No rights of any kind are licensed or assigned or shall otherwise pass to persons accessing this information. You may print copies of the report or information contained within herein for your own private non-commercial use only, provided that you do not change any copyright, trade mark or other proprietary notices. All other copying, reproducing, transmitting, distributing or displaying of material in this report (by any means and in whole or in part) is prohibited.

For the United States

Compliance Notice

This research report prepared by AKD Securities Limited is distributed in the United States to Major US Institutional Investors (as defined in Rule 15a-6 under the Securities Exchange Act of 1934, as amended) only by Decker & Co, LLC, a broker-dealer registered in the US (registered under Section 15 of Securities Exchange Act of 1934, as amended). All responsibility for the distribution of this report by Decker & Co, LLC in the US shall be borne by Decker & Co, LLC. All resulting transactions by a US person or entity should be effected through a registered broker-dealer in the US. This report is not directed at you if AKD Securities Limited or Decker & Co, LLC is prohibited or restricted by any legislation or regulation in any jurisdiction from making it available to you. You should satisfy yourself before reading it that Decker & Co, LLC and AKD Securities Limited are permitted to provide research material concerning investment to you under relevant applicable legislations and regulations.