The business community has welcomed the restoration of the Sales Tax Amendment Act in the erstwhile FATA and PATA regions, calling it a great decision.

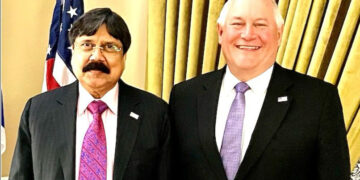

The move will provide a level playing field to industries located in settled areas, which were unable to compete with those located in tribal areas, said Mirza Abdul Rehman, former Vice President of FPCCI and founder President of Attock Chamber of Commerce.

Talking to the business community, he said that the Federally Administered Tribal Areas (FATA) and Provincially Administered Tribal Areas (PATA) were granted special tax exemptions under constitutional arrangements intended to support economic development in these underdeveloped regions.

However, he said, over the years, these exemptions were grossly misused, turning them into tools for tax evasion, money laundering, and commercial manipulation by influential business groups outside the region.

Initially, these tax exemptions aimed to incentivize investment, boost local industry, and integrate marginalized areas into the national economy. However, he observed that the ground realities turned out to be very different.

Mirza Abdul Rehman said that instead of local tribesmen reaping the benefits, these tax exemptions became a haven for business mafias, politically connected individuals, and large industrialists based in other parts of Pakistan.

Major industries, especially sugar mills, textile units, ghee, and steel re-rolling mills, were illegally registered under the names of locals from FATA and PATA while authorities turned a blind eye to this practice, which cost the exchequer billions.

The crooked businessmen used the exempt status to avoid taxes that their competitors in settled areas were legally bound to pay. As a result, an unfair market advantage emerged, distorting competition and discouraging legitimate business activity.

The business leader informed that the government failed to introduce a regulatory mechanism that could distinguish between genuine local enterprises and those exploiting the system through fake documentation or proxy ownership.

The issue became more pronounced after the merger of FATA with Khyber Pakhtunkhwa in 2018. Surprisingly, a five-year transitional period was granted for the continuation of exemptions, providing further opportunity for tax avoidance.

Mirza Abdul Rehman said that these exemptions created a parallel economy. Goods were often routed through FATA and PATA to avoid customs and sales tax, eventually finding their way into settled markets. Many of these activities were linked to smuggling networks and undocumented trade, further weakening fragile tax base.

The government should replace blanket exemptions with targeted subsidies for the locals. Tax authorities must enhance surveillance and transparency. Development funds should be directly channelled into public services like education, health, and infrastructure rather than funnelling tax exemptions into unregulated business activity.

By curbing the misuse of exemptions Pakistan can achieve economic justice, prevent exploitation, and bring real prosperity to the tribal regions.