Fitch Ratings has highlighted that Pakistan will continue to face substantial external financing challenges, despite progress in rebuilding its foreign exchange reserves. The country is required to repay over $22 billion in external debt during fiscal year 2025, including nearly $13 billion in bilateral deposits.

Fitch pointed out that securing adequate external financing remains difficult due to large debt maturities and existing exposure from lenders. Pakistan recently secured a $1 billion loan from two Middle Eastern banks at a 6-7% interest rate, and plans to raise up to $4 billion from Middle Eastern commercial banks by next fiscal year.

To meet its external financing needs from the IMF and other international lenders, Pakistan must continue implementing key structural reforms related to fiscal consolidation and improving the business environment. The country is undergoing reforms under a $7 billion IMF program, which will undergo its first review later this month.

Fitch noted that while the country has made significant progress in rebuilding foreign exchange reserves, delays in IMF reviews could negatively affect external liquidity. On a positive note, Pakistan’s economic activity is benefiting from stability and falling interest rates, with real value-added expected to grow by 3.0% in FY25.

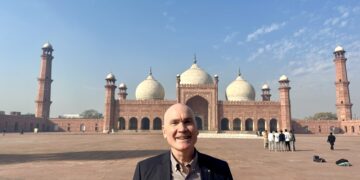

Finance Minister Muhammad Aurangzeb expressed optimism about a potential upgrade in Pakistan’s credit rating, which currently stands at CCC+ by Fitch and Caa2 by Moody’s, both in “junk” territory. He hopes for an upgrade before the fiscal year ends in June.